Apple eked out modest growth in the last three months despite continued gains by smartphone rivals in China. Looking ahead, financial analysts cited concerns about the ongoing iPhone slump in China, high memory prices and Apple’s suit with Qualcomm.

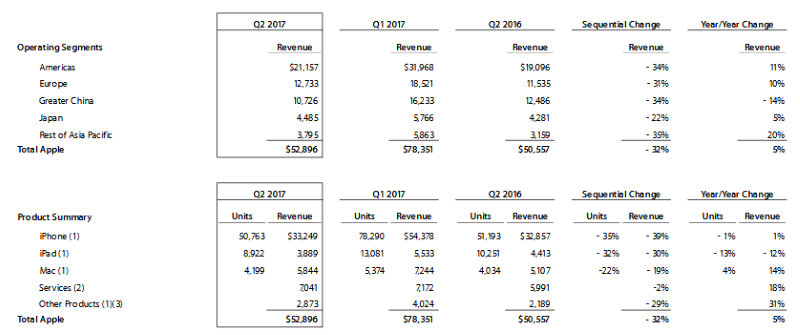

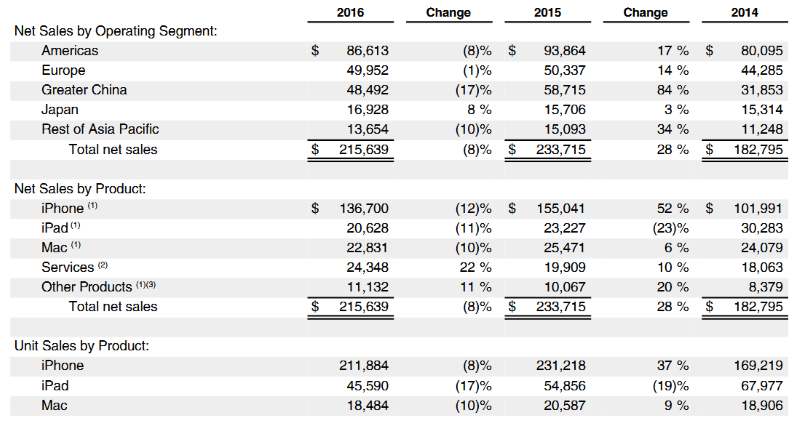

Apple nudged second quarter revenues up 5 percent from the same period last year to $52.896 billion despite a 14 percent decline in sales to China. Overall sales of iPhones—which account for almost two-thirds of Apple’s revenue—were up just 1 percent, while iPads continued their decline with a 12 percent slide and Mac revenues were up 14 percent year-over year.

One analyst on the quarterly call asked why Apple recentlydecided to withhold royalty payments from Qualcomm, risking supply of modem chips and injunctions on iPhones. “Why would Apple take on these risks in advance of what is arguably the largest and most significant product launch of its history” asked Toni Sacconaghi, analyst at Sanford C. Bernstein, referring to the much anticipate tenth-anniversary iPhone.

“Qualcomm has not made an offer to Apple to license its standard-essential patents [SEPs] on fair, reasonable and non-discriminatory terms,” said Apple chief executive Tim Cook. “I don’t believe anyone will enjoin iPhone based on that, there’s plenty of case law around that subject,” Cook said.

The two companies need courts to fix a FRAND rate on the Qualcomm cellular patents, Cook said. “Qualcomm is trying to charge Apple a percentage of the iPhone’s value--they do great work around SEP but its one small part of what an iPhone is and has nothing to do with a gazillion other innovations in the iPhone,” he added.

Apple filed suit against Qualcomm in January, claiming that Qualcomm’s royalties were exorbitant and the chip vendor pressured it to remain silent. In a countersuit filed earlier this month, Qualcomm said that it paid Apple to refrain from asserting patents and revealed that it gets royalty payments for iPhones and iPads through Apple’s contract manufacturers including Compal, Foxconn, Pegatron, and Wistron.

Sacconaghi also questioned whether Apple is making a significant return to iPhone growth after hitting a slump last year, suggesting quarterly sales were below seasonal trends. Cook noted Apple drew down 1.2 million units in iPhone channel inventory in the quarter, more than twice the 450,000 units it purged from the supply chain in the same period a year ago. The average sales price of iPhones increased to $655 from $642 last year, said CFO Luca Maestri.

Responding to a separate question about the China slump, Cook argued Apple has seen the slide slow in the six months compared to the prior six months. “I believe we’ll improve a bit more in this coming quarter, not back to growth but we’ll make more progress. We continue to believe there’s a tremendous opportunity there,” he said.

Over the past year a new cluster of homegrown smartphone makers such as Oppo and Vivo are rising in China. They have joined Huawei and Xiaomi, who have become established players.

Cook noted Mac sales were up 20 percent in China in the quarter. Apple stores in China saw a 27 percent increase in traffic in the period, he said.

Next page: Services, wearables are bright spots

Apple grew revenues five percent despite a 14% slide in China Click to enlarge. (Images: Apple)

Over the last three months, Apple “started to experience some level of cost pressure, particularly on NAND and DRAM,” said Maestri, a trend he expects will continue but be partly offset by a rising services business.

Indeed, services were the bright light in the quarter, growing 18 percent annually to more than $7 billion. Apple expects the sector to double by 2020.

The company has more than 165 million paying subscribers and average revenue per paying account is rising. Apple Music and iCloud services saw double-digit growth in the quarter, and Apple Pay is now available in 15 markets including 4.5 million locations in the U.S. where transactions volumes surged 450 percent, the company reported.

Apple’s outlook for the next quarter, the last before an expected iPhone 8 roll out, called for an expected revenue slide to between $43.5 billion and $45.5 billion.

Overall, Cook said revenues came in at the high end of Apple’s guidance and iPhone sales were in line with expectations. “We feel great about this performance” he said in prepared remarks, noting the company took a hit in foreign currency exchange.

Apple Watch sales doubled year over year, Cook said although the company has yet to provide unit figures. The combination of Apple’s AirPod wireless headsets, its Watch and Beats headphones creates a wearables unit the size of a Fortune 500 company, Cook said.

To drive energy in its stock price, Apple agreed to give another $50 billion to shareholders as part of a program that will return $300 billion by March 2019.