SAN FRANCISCO—Growth in the automotive semiconductor market slowed in 2015 amid currency fluctuations and rampant consolidation that shuffled vendor rankings, according to market research firm IHS Technology Inc.

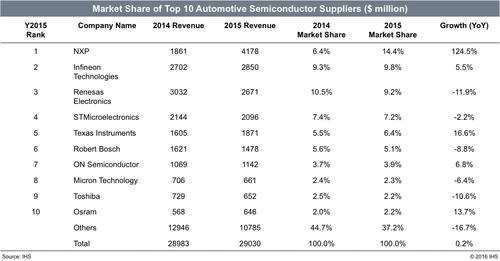

The automotive semiconductor market grew 0.2% last year, reaching $29 billion, IHS (Englewood, Colo.) said.

As reported, NXP Semiconductors NV catapulted to the top of automotive chip suppliers in terms of sales based on its $11.8 billion acquisition of Freescale Semiconductor Inc. NXP’s automotive semiconductor revenue grew by 124% to nearly $4.2 billion, good enough to garner nearly 14.4% of the market, according to IHS.

Ahad Buksh, IHS

“The acquisition of Freescale by NXP created a powerhouse for the automotive market,” said Ahad Buksh, an automotive semiconductor analyst for IHS, in a statement.

Buksh said NXP increased its strength in automotive infotainment systems on the strength of double-digit growth of i.MX processors. NXP’s analog IC revenue also grew by double digits thanks to the increased penetration rate of keyless-entry systems and in-vehicle networking technologies, Buksh added.

Infineon Technologies AG also moved up on the rankings list thanks to its $3 billion acquisition of International Rectifier Corp., IHS said. Infineon’s 9.8% market share in automotive semiconductor sales moved the company to No. 2 on the list, overtaking Renesas Electronics Corp., IHS said.

Click here for larger image

Renesas slipped to third in automotive semiconductor sales in 2015, with a market share of 9.1%, followed by STMicroelectronics NV and Texas Instruments Inc., IHS said.

Renesas was hamstrung by the dollar-to-yen currency exchange rate in 2015 for the third consecutive year, IHS said. The bulk of Renesas’ business comes from Japanese customers. While Renesas’ automotive semiconductor revenue slipped by 12% in dollar terms, it actually grew 1% in yen, the market research firm said.

----Form EE Times