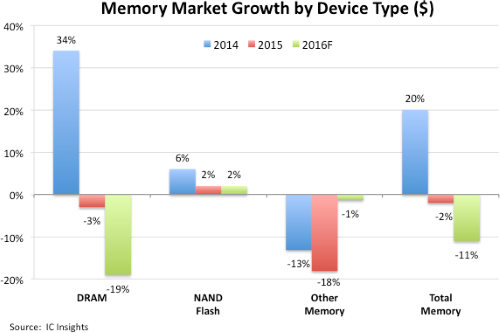

Oversupply of DRAM will drive average selling prices (ASPs) of the memory chips down 16% this year, dragging down the overall IC market to a contraction of 2% in 2016, according to the latest report from market watcher IC Insights.

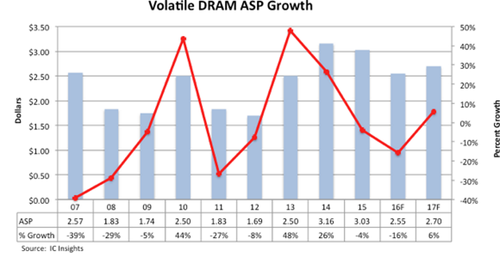

Declining shipments of PC, notebooks and tablets as well as a slowdown in smartphone growth will contribute to an overall decline of 19% in the DRAM market this year, the company said. DRAM prices are known for big swings with ASPs hitting a recent high of $3.16 in 2014 up from a recent low of $1.69 in 2012.

DRAM oversupply will drag overall memory sales down 11% this year, the report said. (Images: IC Insights)

A plot of DRAM ASPs since 2007 (below) looks “like the profile of an alpine mountain range,” IC Insights said. Demand from servers and new smartphone models started kicking DRAM prices back up this summer toward a forecasted rise to $2.70 in 2017.

The upturn may be short lived, IC Insights said. Two China-based companies --Sino King Technology in Hefei, and Fujian Jin Hua IC Company -- plan to start producing DRAM in late 2017 or early 2018.

“It remains to be seen what devices and what technology the two new entrants will offer but their presence in the market could signal that another round of price declines is around the corner,” the report said.

----Form EE Times